PLUS: Apple's second-largest acquisition ever, Tesla's shift to humanoid robots, and AI disrupting software stocks

Good morning

Google AI has unveiled a new research prototype, Project Genie, that can generate entire interactive and playable worlds from a single prompt. The tool goes beyond static images, creating dynamic environments that users can explore in real time.

This technology represents a significant step from generating simple images or videos into creating complex, explorable world models. The big question is how quickly this will reshape industries from gaming to robotics, putting world-building capabilities into anyone's hands.

In today’s Next in AI recap:

Google's Genie generates infinite playable worlds

Apple's $2B 'silent speech' AI acquisition

Tesla pivots from cars to humanoid robots

AI disruption fears hit software stocks

Google's Infinite Worlds

Next in AI: Google AI unveiled Project Genie, an experimental research prototype that can generate interactive, playable worlds from a single text or image prompt. This tool allows users to create and explore dynamic environments in real time.

Decoded:

The system generates environments in real time as you move, simulating physics and interactions to create a dynamic experience unlike static 3D snapshots.

Users can create worlds with text and images, fine-tune the visuals using a "World Sketching" feature, and even remix existing worlds to build new interpretations.

Access is initially rolling out to Google AI Ultra subscribers in the U.S. and is considered an early prototype with limitations, including a 60-second generation cap.

Why It Matters:This move represents a significant step beyond simple image or video generation, pushing into the realm of complex world models. The technology points to a future where anyone can create and test scenarios, from game development to robotics simulations, directly from a prompt.

Apple's $2B AI Play

Next in AI: Apple just acquired Israeli startup Q.ai for nearly $2 billion to integrate groundbreaking AI that can interpret 'silent speech' from facial movements.

Decoded:

The deal, valued at nearly $2 billion, marks Apple's second-largest acquisition ever, right after its $3 billion purchase of Beats Electronics in 2014.

Q.ai’s technology analyzes subtle facial muscle activity, paving the way for future non-verbal interactions with devices like sending silent commands to Siri.

The startup’s CEO, Aviad Maizels, previously sold the 3D-sensing company PrimeSense to Apple, which became the core technology for Face ID on the iPhone.

Why It Matters:This acquisition points toward a future of more seamless human-computer interfaces for devices like the Vision Pro and AirPods. By purchasing proven technology and talent, Apple is doubling down on integrating advanced AI directly into its hardware ecosystem.

Tesla's Robot Revolution

Next in AI: Tesla is ending production of its Model S and Model X vehicles, signaling a major strategic pivot to focus its manufacturing capacity on its Optimus humanoid robot.

Decoded:

The move follows Tesla's first-ever annual revenue drop, with the company reporting a 3% decline in 2025 and a 61% profit fall in the last quarter.

Its California manufacturing plant will be repurposed from producing the low-volume cars to building the Optimus robot line instead.

Tesla is also deepening its AI bet by investing $2 billion in Elon Musk's separate venture, xAI, despite mixed shareholder feedback.

Why It Matters:This strategic pivot reframes Tesla from an electric vehicle maker into a full-fledged AI and robotics company. The company is betting its future growth on autonomous systems, marking a significant departure from its original automotive focus.

AI Fears Hammer Software Stocks

Next in AI: Investor anxiety over AI disruption sent software stocks tumbling despite strong earnings. Even top performers like Microsoft and ServiceNow saw sharp declines as the market grapples with fears that AI could upend traditional business models.

Decoded:

The iShares software ETF tumbled into bear market territory, falling over 22% as investors fled the sector in a single trading session.

The sell-off reflects a deeper worry that emerging AI platforms could make legacy software licensing obsolete, threatening the core revenue streams of established tech giants.

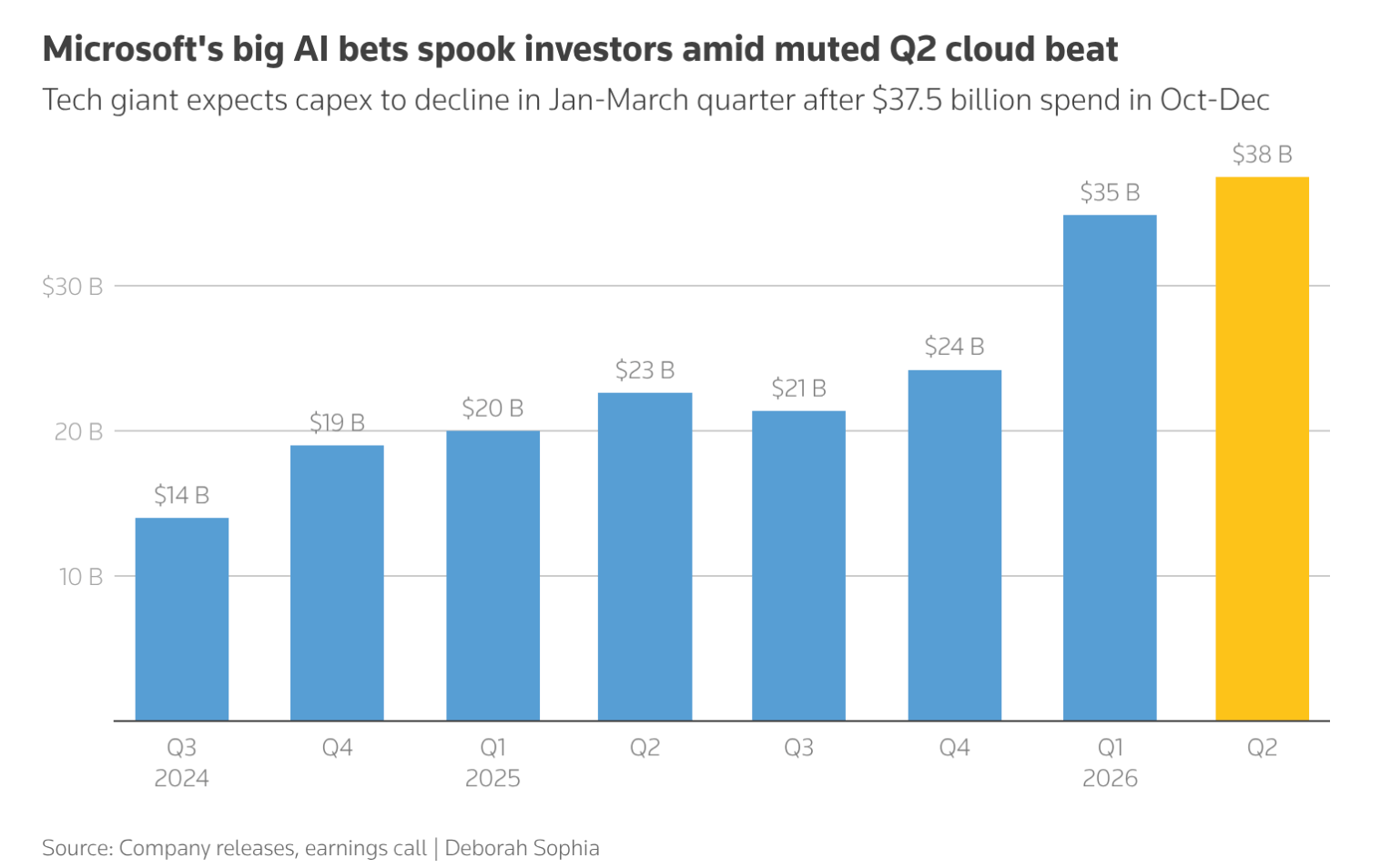

Microsoft dropped 10% after earnings despite solid results, as its data center spending surged 66% and raised concerns about the massive costs required to compete in AI infrastructure.

Why It Matters:This is not a typical earnings-driven correction. The market is fundamentally reassessing which software companies have viable strategies to survive in an AI-first world, and current profitability is no longer enough to calm investor nerves.

AI Pulse

Advantest posted record quarterly sales and raised its profit forecast by over 21%, citing soaring demand for its chip-testing equipment used in high-performance AI semiconductors.

Swedish researchers published the results of a 100,000-woman trial showing that AI-supported mammography screening led to a 12% reduction in later-stage cancer diagnoses and a higher rate of early detection.

An AI-generated blog sent droves of tourists in search of non-existent hot springs in Tasmania after the operator of a tour company website published the AI’s “hallucinated” travel recommendations without review.

AgentMail launched its API that gives AI agents their own fully-functional email inboxes, allowing them to perform long-running, asynchronous tasks and communicate with humans or other agents via a universal protocol.