PLUS: The 70% productivity myth, a medical AI breakthrough, and the ARR illusion

Good morning

Nvidia is reportedly in talks to acquire AI startup AI21 Labs for up to $3 billion, marking a significant strategic pivot for the chip giant. This move would transform Nvidia from a hardware provider into a company that owns both the infrastructure and the AI models that run on it.

By vertically integrating across the AI stack, Nvidia would gain unprecedented control over the entire ecosystem. The question is whether this consolidation will accelerate innovation or create new bottlenecks in an already concentrated market.

In today's Next in AI:

Nvidia's potential $3B acquisition of AI21 Labs

Why AI productivity gains may be overstated

AI identifies new multiple sclerosis subtypes

The truth behind AI startup revenue metrics

Nvidia's $3B AI Brain

Next in AI: Nvidia is reportedly in advanced talks to acquire AI startup AI21 Labs for as much as $3 billion. This potential deal marks a major move for the chipmaker, shifting its strategy from powering AI to owning the foundational models that run on its hardware.

Decoded:

The deal's price tag, estimated between $2-3 billion, would more than double AI21's $1.4 billion valuation from a 2023 funding round where Nvidia was also an investor.

Sources suggest the acquisition is primarily an "acqui-hire," targeting AI21's 200-person team for its rare expertise in AI development.

This move aligns with Nvidia's significant expansion in Israel, where the company is planning a new R&D campus for up to 10,000 employees.

Why It Matters: Acquiring AI21 Labs signals Nvidia's ambition to move up the value chain from hardware provider to a vertically integrated AI powerhouse. By owning both the chips and the models, Nvidia aims to control the entire AI ecosystem from the ground up.

The Productivity Mirage

Next in AI: The massive 70-90% AI productivity gains being advertised are a mirage for most companies, especially those with legacy systems. Even AI pioneer Andrej Karpathy describes the current shift as a "magnitude 9 earthquake" that is fundamentally changing development.

Decoded:

A randomized study found that experienced developers using AI tools were actually 19% slower on tasks, despite believing they were 20% faster.

Developer trust is eroding, as The 2025 Developer Survey reveals 46% of developers now actively distrust AI output accuracy—a sharp increase from 31% last year.

The impressive gains are real but limited to a small segment, like AI-native startups and greenfield projects that don't have to contend with decades of technical debt.

Why It Matters: True productivity gains come from modernizing systems and processes, not just adding a new tool. Leaders should focus on targeted use cases and internal benchmarks rather than chasing universal hype.

AI's Medical Breakthrough

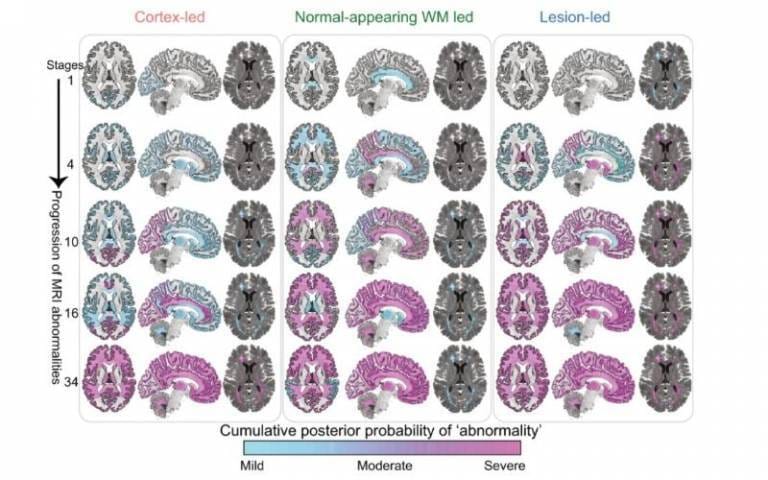

Next in AI: In a major win for AI in science, researchers used machine learning and MRI scans to discover two entirely new biological subtypes of multiple sclerosis, paving the way for personalized treatments and better patient outcomes.

Decoded:

The AI model, named SuStaIn, analyzed MRI scans and blood levels of a protein that signals nerve cell damage to identify distinct disease patterns.

It identified an aggressive "early sNfL" subtype with rapid brain lesion development and a slower "late sNfL" subtype where brain shrinkage occurs before other damage is apparent.

These findings, published in Brain, could shift MS treatment from a symptom-based approach to a biologically-driven one, enabling more personalized care.

Why It Matters: This application of AI moves medical diagnostics beyond human observation, allowing doctors to see and treat the root cause of a disease. It's a powerful example of how machine learning can uncover hidden biological patterns to improve human health.

AI's ARR Illusion

Next in AI: A critical look at AI startup financials reveals many are reporting total transaction value (GMV) as recurring revenue (ARR), masking their true, lower-margin business models.

Decoded:

Many AI companies function more like low-margin resellers, where a large portion of customer payments immediately flows out to cover external costs like LLM APIs and GPU compute.

Startups adopt the language of SaaS to signal stability and attract higher valuations, even when their revenue isn't truly recurring or owned by the company.

The argument that compute costs will eventually fall often overlooks that demand constantly shifts to the newest and most powerful models, keeping real-world expenses high.

Why It Matters: This isn't just about accounting; it's an identity crisis that determines if a company is building sustainable value or just brokering transactions. Investors and builders must look beyond top-line numbers to understand a company's true profitability and control over its financial future.

AI Pulse

OpenAI plans to tap private investors for as much as $100 billion in 2026, highlighting the massive capital requirements needed to lead in AI model development.

Yoshua Bengio warned against granting rights to AI, stating that frontier models are already showing signs of self-preservation in experimental settings and that humans must retain the ability to shut them down.

Kapwing found that over 21% of videos shown to a new YouTube account are low-quality, AI-generated "slop," highlighting the rapid proliferation of careless AI content used to farm views.