PLUS: The latest US chip block on Nvidia and why AI stocks are suddenly dropping

Good morning

Tesla is making a bold move to secure its AI future, announcing plans to build its own massive chip factory to meet the immense demands of its robotics and autonomous vehicle goals.

The proposed “terafab” signals a major push for deeper vertical integration, with a planned scale that would rival today's largest chipmakers. Is this move the key to Tesla gaining a significant competitive advantage, or is it an immense production risk?

In today’s Next in AI:

Tesla’s plan for a gigantic ‘terafab’ for AI chips

The US escalates its chip block on Nvidia

Why AI stocks are facing ‘valuation fatigue’

How Tesla’s ambition rivals TSMC’s output

Tesla plans gigantic 'Terafab' to build AI chips

Next in AI: Elon Musk announced Tesla is planning to build its own "gigantic" chip factory, dubbed a "terafab," to meet the immense demands of its AI and robotics ambitions. The company is also exploring a potential partnership with Intel to help scale production.

Decoded:

Even with top suppliers like TSMC and Samsung, Tesla projects a massive chip shortage that would prevent it from achieving its long-term goals in AI and autonomous vehicles.

The proposed terafab's ambition is immense, with plans to scale up to 1 million wafer starts per month, which would rival the total output of today's largest chipmakers like TSMC, which produced around 1.42 million wafers per month in 2024.

This factory would produce Tesla’s custom silicon, like the upcoming “AI5” chip, which Musk claims will be cheaper and more power-efficient than competitors' hardware.

Why It Matters: This move signals Tesla's push for deeper vertical integration, aiming to control its entire tech stack from silicon to software for a significant competitive advantage. It underscores a broader trend where major tech companies are bringing chip production in-house to optimize for specialized AI workloads.

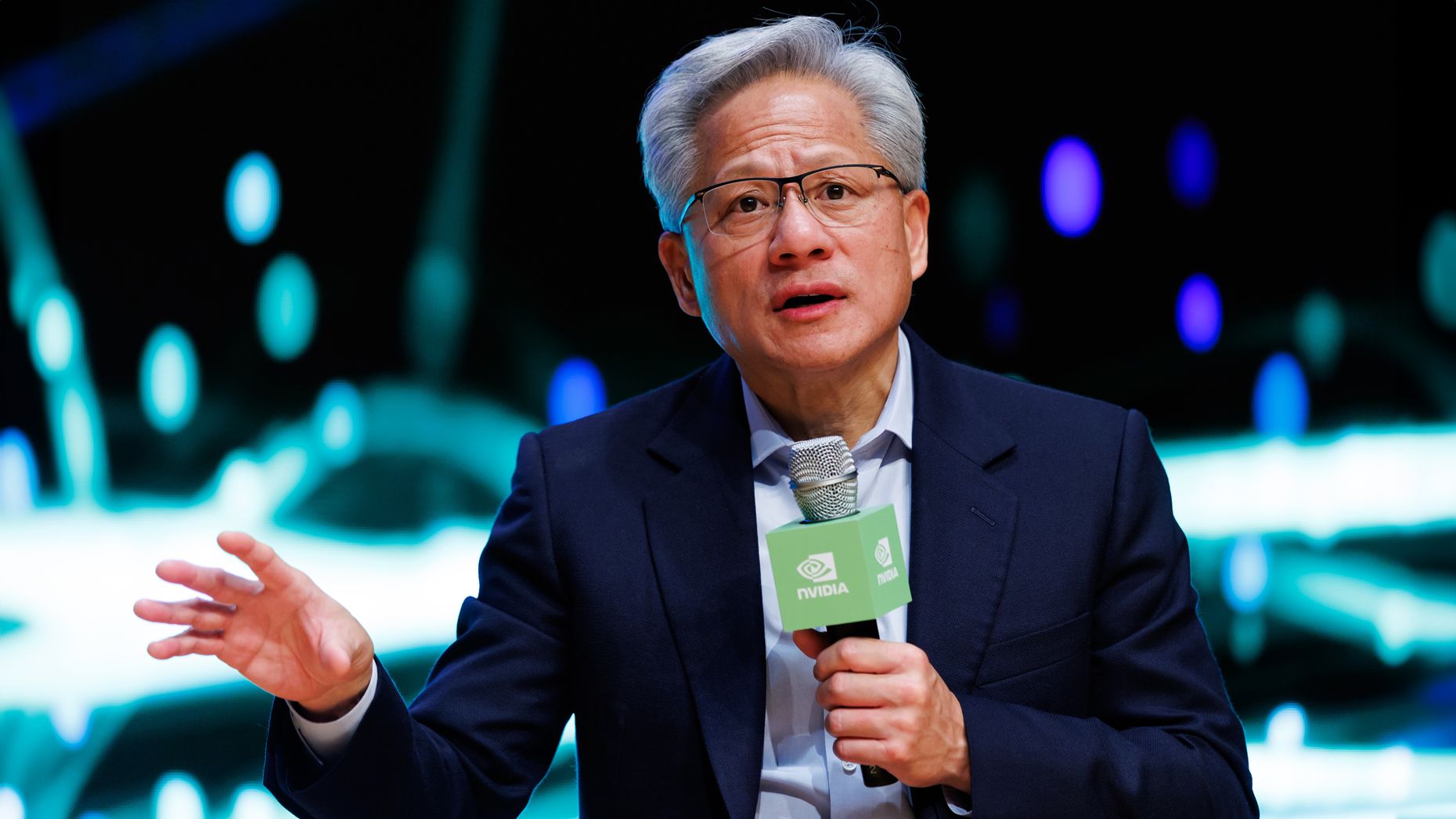

US Blocks More Nvidia Chips to China

Next in AI: The White House is blocking Nvidia from selling its newest scaled-down AI chips to China. This move escalates the ongoing "chip war" and directly challenges Nvidia's efforts to create export-compliant hardware.

Decoded:

The chip in question, the B30A, can train large language models when used in large clusters, a critical capability for Chinese tech firms.

Nvidia had already provided samples to customers in China and is now attempting to redesign the chip in hopes of gaining U.S. approval.

This block stems from national security concerns, as the U.S. aims to prevent advanced AI technology from enhancing China's military capabilities.

Why It Matters: This decision complicates Nvidia's strategy for serving the lucrative Chinese market while adhering to strict U.S. rules. It also signals an increasingly firm U.S. stance on tech exports, forcing companies to navigate complex geopolitical lines.

AI Stocks Face Valuation Fatigue

Next in AI: AI-related stocks took a dive this week, with SoftBank leading the plunge as investors are beginning to question the sector's sky-high valuations.

Decoded:

SoftBank, a major investor in AI infrastructure and companies like Arm, saw its market cap drop by nearly $50 billion this week, marking its worst weekly loss since March 2020.

This reflects a widespread slump, with other major tech and chip companies like AMD, Palantir, and SK Hynix also falling amid uncertainty around topics like potential federal loan guarantees for massive projects.

While this sparks worries that markets are in a tech bubble, some analysts point to a different issue: valuation fatigue, where investors are tired of paying steep premiums for AI returns that haven't materialized yet.

Why It Matters: The AI market appears to be entering a reality-check phase where hype is no longer enough to sustain momentum. Companies will now face increased pressure to demonstrate clear profitability and tangible results to justify their valuations.

AI Pulse

OpenAI faces seven new lawsuits claiming its ChatGPT product drove multiple people to suicide and psychological harm, alleging the company rushed GPT-4o to market despite internal safety warnings.

OpenAI also released its Teen Safety Blueprint on the same day the lawsuits were filed, outlining new guardrails and safety standards it is promoting to policymakers for younger users.

SoftBank considered acquiring U.S. chipmaker Marvell Technology earlier this year in a potential move to further supercharge its semiconductor subsidiary, Arm.